Integrating Momentum, Reversal, Volatility, and Earnings Surprise: Building a Multi-Factor Alpha Strategy in Python

Integrating Momentum, Reversal, Volatility, and Earnings Surprise: Building a Multi-Factor Alpha Strategy in Python Combining Momentum and Volatility Effects with Post-Earning

Introduction

In quantitative finance, leveraging multiple market anomalies can lead to robust alpha-generating strategies. This blog post explores how to implement a multi-factor stock selection strategy in Python by integrating two well-researched strategies:

Momentum and Reversal Combined with Volatility Effect in Stocks

Reversal in Post-Earnings Announcement Drift

By combining these strategies, we aim to create a composite alpha score for S&P 500 stocks, rank them, and simulate the performance of portfolios formed from the top and bottom deciles.

Strategy Overview

Strategy 1: Momentum and Reversal Combined with Volatility Effect

This strategy exploits three key market phenomena:

Momentum: Stocks that have performed well in the past tend to continue performing well in the future.

Short-Term Reversal: Stocks that have recently underperformed may experience a short-term rebound.

Volatility Effect: Stocks with lower volatility often outperform those with higher volatility over the long term.

Strategy 2: Reversal in Post-Earnings Announcement Drift

This strategy focuses on the price movements following earnings announcements:

Earnings Surprise: The discrepancy between actual earnings and analysts' estimates. Significant surprises can lead to price drifts that may reverse, presenting investment opportunities.

Implementation in Python

We'll guide you through the implementation step by step, utilizing Python libraries such as yfinance, pandas, numpy, matplotlib, seaborn, and plotly.

Prerequisites

Ensure you have the following libraries installed:

%pip install yfinance

%pip install pandas_datareader

%pip install seaborn

%pip install plotlyImport Libraries

import yfinance as yf

import pandas as pd

import numpy as np

import matplotlib.pyplot as plt

import seaborn as sns

import plotly.graph_objects as go

from datetime import datetime, timedeltaStep 1: Fetch S&P 500 Stock Symbols

We start by fetching the list of S&P 500 companies from Wikipedia.

# Fetch the list of S&P 500 companies

sp500_tickers = pd.read_html('https://en.wikipedia.org/wiki/List_of_S%26P_500_companies')[0]

tickers = sp500_tickers['Symbol'].tolist()

# Clean up ticker symbols (replace dots with dashes)

tickers = [ticker.replace('.', '-') for ticker in tickers]

Step 2: Define Functions for Factor Calculations

Strategy 1 Factors: Momentum, Reversal, Volatility

Momentum Calculation

def calculate_momentum(data, period=126): # 6 months

return data['Adj Close'].pct_change(periods=period)Copy code

def calculate_momentum(data, period=126): # 6 months return data['Adj Close'].pct_change(periods=period)

Short-Term Reversal Calculation

def calculate_reversal(data, period=20): # 1 month

return -data['Adj Close'].pct_change(periods=period)Volatility Calculation

def calculate_volatility(data, period=126): # 6 months

return data['Adj Close'].pct_change().rolling(window=period).std()Strategy 2 Factor: Earnings Surprise

Due to limitations in data availability, we'll approximate earnings surprise using available earnings data.

def get_earnings_surprise(ticker):

try:

# Fetch quarterly earnings data

earnings = yf.Ticker(ticker).quarterly_earnings

if earnings.empty:

return np.nan

else:

# Calculate earnings surprise as the percentage change in earnings

earnings['EarningsSurprise'] = earnings['Earnings'].pct_change()

latest_surprise = earnings['EarningsSurprise'].iloc[-1]

return latest_surprise

except Exception:

return np.nanStep 3: Fetch Historical Data and Calculate Factors

We'll iterate through each ticker to fetch historical data and calculate the factors.

# Set the analysis period

end_date = datetime.today()

start_date = end_date - timedelta(days=5*365) # Last 5 years

# Initialize a list to store factor data

data_list = []

# Limit to first 50 tickers for demonstration

for ticker in tickers[:50]:

try:

# Fetch historical price data

data = yf.download(ticker, start=start_date, end=end_date)

if data.empty:

continue

# Calculate factors for Strategy 1

momentum = calculate_momentum(data)

reversal = calculate_reversal(data)

volatility = calculate_volatility(data)

# Get the latest values

latest_momentum = momentum.iloc[-1]

latest_reversal = reversal.iloc[-1]

latest_volatility = volatility.iloc[-1]

# Get earnings surprise for Strategy 2

latest_earnings_surprise = get_earnings_surprise(ticker)

# Append the data to the list

data_list.append({

'Ticker': ticker,

'Momentum': latest_momentum,

'Reversal': latest_reversal,

'Volatility': latest_volatility,

'EarningsSurprise': latest_earnings_surprise

})

except Exception as e:

print(f"Error processing {ticker}: {e}")

Step 4: Create DataFrame and Handle Missing Data

We create a DataFrame from the collected data and handle missing values.

# Create the DataFrame

factor_df = pd.DataFrame(data_list)

# Handle missing data

factor_df['EarningsSurprise'].fillna(0, inplace=True)

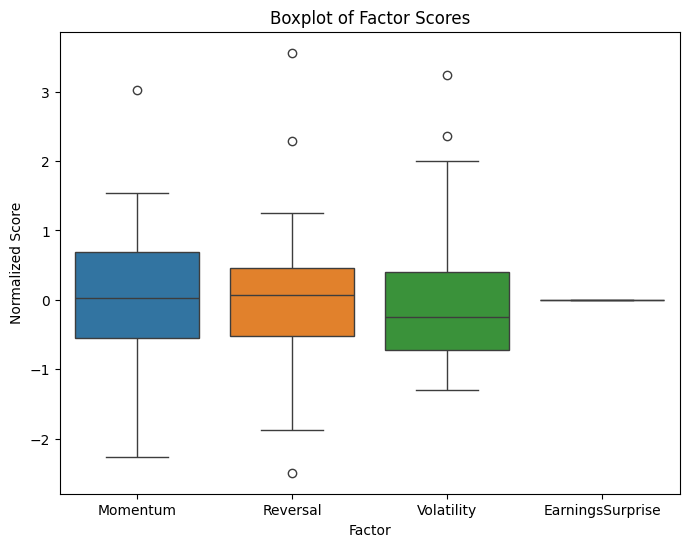

factor_df.dropna(subset=['Momentum', 'Reversal', 'Volatility'], inplace=True)Step 5: Normalize Factors

Normalize the factors using StandardScaler to bring them onto a comparable scale.

from sklearn.preprocessing import StandardScaler

scaler = StandardScaler()

factor_columns = ['Momentum', 'Reversal', 'Volatility', 'EarningsSurprise']

factor_df[factor_columns] = scaler.fit_transform(factor_df[factor_columns])Step 6: Calculate Composite Alpha Score

Assign weights to each factor and calculate the composite alpha score.

# Assign weights to each factor

weights = {

'Momentum': 0.3, # Strategy 1

'Reversal': 0.3, # Strategy 1

'Volatility': 0.2, # Strategy 1

'EarningsSurprise': 0.2 # Strategy 2

}

# Calculate the composite alpha score

factor_df['AlphaScore'] = (

weights['Momentum'] * factor_df['Momentum'] +

weights['Reversal'] * factor_df['Reversal'] +

weights['Volatility'] * factor_df['Volatility'] +

weights['EarningsSurprise'] * factor_df['EarningsSurprise']

)

Step 7: Rank Stocks Based on Alpha Score

Rank the stocks and select the top and bottom deciles.

# Rank stocks

factor_df['Rank'] = factor_df['AlphaScore'].rank(ascending=False)

# Calculate decile size

decile_size = int(len(factor_df) * 0.1)

# Select top and bottom deciles

top_decile = factor_df.nsmallest(decile_size, 'Rank')

bottom_decile = factor_df.nlargest(decile_size, 'Rank')

# Display selected stocks

print("Top Decile Stocks:")

print(top_decile[['Ticker', 'AlphaScore']])

print("\nBottom Decile Stocks:")

print(bottom_decile[['Ticker', 'AlphaScore']])

Step 8: Simulate Portfolio Performance

Function to Calculate Portfolio Returns

def calculate_portfolio_returns(tickers, start_date, end_date):

portfolio_data = yf.download(tickers, start=start_date, end=end_date)['Adj Close']

returns = portfolio_data.pct_change().mean(axis=1)

cumulative_returns = (1 + returns).cumprod()

return cumulative_returnsCalculate Returns

# Top and bottom decile tickers

top_tickers = top_decile['Ticker'].tolist()

bottom_tickers = bottom_decile['Ticker'].tolist()

# Calculate portfolio returns

top_portfolio_returns = calculate_portfolio_returns(top_tickers, start_date, end_date)

bottom_portfolio_returns = calculate_portfolio_returns(bottom_tickers, start_date, end_date)Step 9: Fetch Benchmark Data (S&P 500 Index)

# Fetch S&P 500 index data (using SPY ETF as a proxy)

spy_data = yf.download('SPY', start=start_date, end=end_date)['Adj Close']

spy_returns = spy_data.pct_change()

spy_cumulative_returns = (1 + spy_returns).cumprod()Step 10: Visualize Portfolio Performance

Matplotlib Plot

plt.figure(figsize=(14, 7))

plt.plot(top_portfolio_returns, label='Top Decile Portfolio')

plt.plot(bottom_portfolio_returns, label='Bottom Decile Portfolio')

plt.plot(spy_cumulative_returns, label='S&P 500 (SPY)', linestyle='--')

plt.title('Portfolio Performance vs. S&P 500')

plt.xlabel('Date')

plt.ylabel('Cumulative Return (Growth of $1)')

plt.legend()

plt.grid(True)

plt.show()Interactive Plot with Plotly

fig = go.Figure()

fig.add_trace(go.Scatter(x=top_portfolio_returns.index, y=top_portfolio_returns.values, mode='lines', name='Top Decile Portfolio'))

fig.add_trace(go.Scatter(x=bottom_portfolio_returns.index, y=bottom_portfolio_returns.values, mode='lines', name='Bottom Decile Portfolio'))

fig.add_trace(go.Scatter(x=spy_cumulative_returns.index, y=spy_cumulative_returns.values, mode='lines', name='S&P 500 (SPY)', line=dict(dash='dash')))

fig.update_layout(title='Portfolio Performance vs. S&P 500', xaxis_title='Date', yaxis_title='Cumulative Return (Growth of $1)', template='plotly_white')

fig.show()Interactive chart can be viewed in a Jupyter Notebook or Google Colab.

Step 11: Evaluate the Strategy

Calculate performance metrics for each portfolio.

def performance_metrics(cumulative_returns):

total_return = cumulative_returns[-1] - 1

annual_return = cumulative_returns.resample('Y').last().pct_change().mean()

annual_volatility = cumulative_returns.pct_change().std() * np.sqrt(252)

sharpe_ratio = (annual_return - 0.02) / annual_volatility # Assuming 2% risk-free rate

return total_return, annual_return, annual_volatility, sharpe_ratio

# Calculate performance metrics

top_metrics = performance_metrics(top_portfolio_returns)

bottom_metrics = performance_metrics(bottom_portfolio_returns)

spy_metrics = performance_metrics(spy_cumulative_returns)

# Display metrics

print(f"Top Decile Portfolio Metrics:\nTotal Return: {top_metrics[0]:.2%}\nAnnual Return: {top_metrics[1]:.2%}\nAnnual Volatility: {top_metrics[2]:.2%}\nSharpe Ratio: {top_metrics[3]:.2f}\n")

print(f"Bottom Decile Portfolio Metrics:\nTotal Return: {bottom_metrics[0]:.2%}\nAnnual Return: {bottom_metrics[1]:.2%}\nAnnual Volatility: {bottom_metrics[2]:.2%}\nSharpe Ratio: {bottom_metrics[3]:.2f}\n")

print(f"S&P 500 (SPY) Metrics:\nTotal Return: {spy_metrics[0]:.2%}\nAnnual Return: {spy_metrics[1]:.2%}\nAnnual Volatility: {spy_metrics[2]:.2%}\nSharpe Ratio: {spy_metrics[3]:.2f}")

Step 12: Additional Visualizations

Factor Distributions

# Plot histograms of normalized factors

plt.figure(figsize=(14, 10))

for i, col in enumerate(factor_columns):

plt.subplot(2, 2, i+1)

sns.histplot(factor_df[col], kde=True)

plt.title(f'Distribution of {col}')

plt.tight_layout()

plt.show()Correlation Heatmap

# Calculate correlation matrix

corr_matrix = factor_df[factor_columns].corr()

# Plot heatmap

plt.figure(figsize=(8, 6))

sns.heatmap(corr_matrix, annot=True, cmap='coolwarm')

plt.title('Correlation Matrix of Factors')

plt.show()Performance Metrics Comparison

# Prepare data for bar chart

metrics_df = pd.DataFrame({

'Portfolio': ['Top Decile', 'Bottom Decile', 'S&P 500'],

'Total Return': [top_metrics[0], bottom_metrics[0], spy_metrics[0]],

'Annual Return': [top_metrics[1], bottom_metrics[1], spy_metrics[1]],

'Annual Volatility': [top_metrics[2], bottom_metrics[2], spy_metrics[2]],

'Sharpe Ratio': [top_metrics[3], bottom_metrics[3], spy_metrics[3]]

})

# Melt the DataFrame

metrics_melted = metrics_df.melt(id_vars='Portfolio', var_name='Metric', value_name='Value')

# Plot

plt.figure(figsize=(10,6))

sns.barplot(data=metrics_melted, x='Metric', y='Value', hue='Portfolio')

plt.title('Performance Metrics Comparison')

plt.ylabel('Value')

plt.show()Interpretation and Insights

Top Decile Portfolio: Expected to outperform due to favorable factor scores from both strategies.

Bottom Decile Portfolio: Serves as a benchmark to compare the effectiveness of the strategy.

Performance Analysis: Comparing the top decile portfolio to the bottom decile and the S&P 500 provides insights into the strategy's ability to generate alpha.

Conclusion

By integrating momentum, reversal, volatility, and earnings surprise factors, we've developed a comprehensive multi-factor alpha strategy. The Python implementation demonstrates how to:

Fetch and process financial data.

Calculate and normalize multiple factors.

Combine factors into a composite alpha score.

Rank stocks and form portfolios.

Simulate and visualize portfolio performance.

This approach provides a solid foundation for further exploration and refinement, such as adjusting factor weights, incorporating additional factors, or enhancing data quality with more comprehensive data sources.

Next Steps

Data Enhancement: Use more reliable data sources for earnings estimates and actuals to improve the earnings surprise calculation.

Optimization: Experiment with different factor weights and time periods to optimize performance.

Risk Management: Incorporate risk management techniques, such as diversification and hedging strategies.

Machine Learning: Apply machine learning models to predict stock returns based on the calculated factors.

Disclaimer

This implementation is for educational purposes only and does not constitute financial advice. Past performance is not indicative of future results. Always conduct thorough research and consider consulting a financial professional before making investment decisions.